With the rising cost of everything from coffee to A/V equipment, creating (and sticking to!) an event budget is more valuable than ever.

Why is budgeting important when planning an event? Well, for starters, a thoughtful budget can mean the difference between a financial flop and a massive success story.

By bringing your financial details into one place, event budgeting makes it easier for you to:

So, although event budgeting might not be the most exciting part of planning an event, it should be one of your top priorities–especially if you want to deliver amazing event experiences without going over budget.

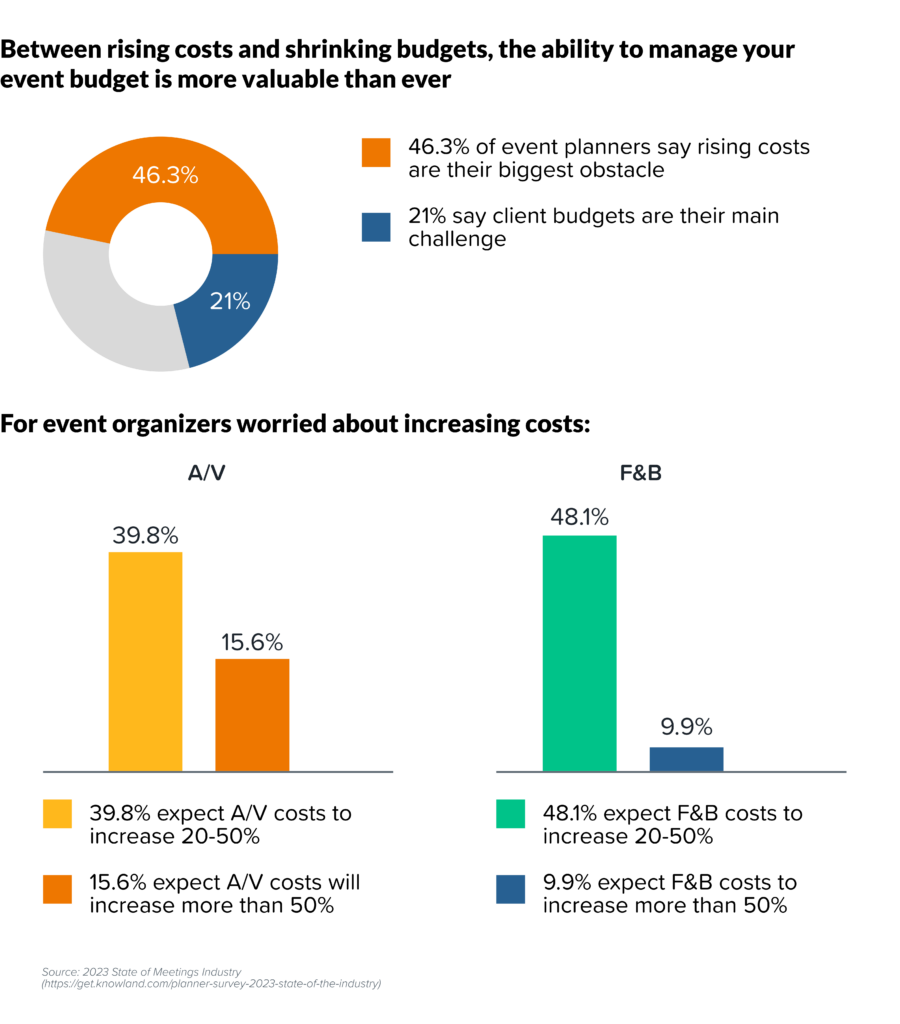

According to Knowland’s 2023 State of the Meetings Industry, increasing event expenses is one of the biggest concerns for event organizers. In fact, almost half (46.3%) of event professionals said rising costs are their biggest obstacle when planning events. Another 21% named shrinking client budgets as their top challenge.

The same survey asked event organizers about their predictions on rising costs and most respondents felt food and A/V costs were most likely to continue increasing:

An event budget is a financial roadmap for your event. It helps you organize your projected expenses and revenue so you can effectively manage your resources and stay on track to achieve your event goals.

Categories within your event budget may include:

Planning your budget ahead of time prevents your team from overspending and sets realistic expectations for how much money you can afford to allocate to different areas of your event. That way, you can better prioritize which aspects you’d like to spend more on. For example, if you find that you have to choose between a larger event venue or an upgraded catering package, you can make an informed, data-backed decision based on which is more important to your team.

Developing a clear event budget also helps you measure your success at the end of your event. In reality, your actual revenue and expenses will likely differ from what you projected, but these benchmarks help you determine whether you generated more or less revenue than expected and adjust your budgeting strategy accordingly for future events.

Ultimately, an event budget is a necessary tool for managing your event finances and making careful decisions during the event planning process.

One of the key challenges for planners is managing expenses and revenue sources to achieve the financial goals set by your organization.

A budget provides a detailed forecast of your event’s finances. It helps you manage your spending and expectations by outlining exactly what you’re spending on (including fixed costs and variable expenses), your predicted revenue, and how much revenue you need to earn to meet your goals. This applies whether you’re creating a corporate event budget, trade show budget, or conference budget.

So, when you begin event budget planning, focus on determining which items represent expenses and which are sources of revenue that can help cover costs. You’ll also need to distinguish between fixed and variable costs to effectively forecast a budget for your next event.

Leveraging event management software like EventMobi which offers event apps, virtual event software, and a hybrid event platform can help streamline many of the processes.

One of the first steps for every event planner is preparing an event profit and loss budget and predicting as accurately as possible if the event will result in a profit, loss, or break even. However, determining what financial success means for your event depends on the type of event and objectives.

Although you won’t be able to forecast all expenses and revenue from the beginning—and some of these could even change during the planning process—it’s vital to plan your budget with consideration for the most common expenses and revenues.

As part of your event cost breakdown, it’s critical to differentiate between fixed costs and variable expenses.

Fixed costs are costs that do not change based on the number of attendees. These costs are calculated as a total amount. Variable costs are event expenses that change based on the number of attendees. These costs are calculated on a per-person basis.

| Example | |||

| Number of People | 200 | 400 | |

| Food & Beverage ($35/person) | $8,000 | $16,000 | Variable |

| Venue Rental | $5,000 | $5,000 | Fixed |

| Entertainment | $2,000 | $2,000 | Fixed |

| Total | $15,000 | $23,000 | |

| Average Cost / Attendee | $75/attendee | $57.50/attendee | |

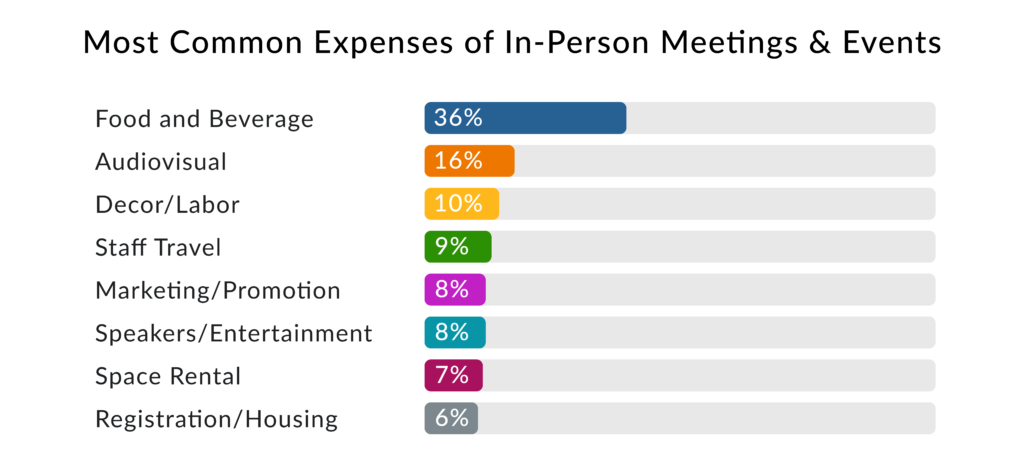

According to a Professional Convention Management Association (PCMA) survey, 36% of all in-person event expenses are for food and beverages (F&B) alone. This chart shows an overview of the most common expenses for meetings and events. Note that event technology can be incorporated into all of these common expenses. For example, event registration software can help with marketing and promotion by allowing event planners to automate emails about important speakers and sessions.

Your meetings and events are about the attendee experience, so you have to ensure that you’re investing in aspects of your even that add value to your target audience.

For instance, attendees don’t care if you pay $240 for a gallon of coffee or $45 per person for a continental breakfast. They do, however, care about an overall great experience–and the quality of your food and beverage is a large component of attendee satisfaction.

PCMA suggests spending 55% of your budget on food and beverage, audiovisual, and speaker or entertainment, because these items have a direct impact on the overall attendee experience.

For a fully customized and branded virtual event, there are three common expenses that planners should consider budgeting for:

The costs attributed to each of these line items will vary based on the scale of the event you are organizing. In many cases, there are do-it-yourself design options for the platform, or you may want to have your event space custom-designed to embody the essence of your brand. Streaming services also vary widely. You can use ZOOM to self-produce at a low cost, or some virtual event platforms (like Eventmobi) have built-in DIY live streaming tools that will allow you to create live streams from within the platform. This tends to be a mid-level price option. Alternatively for higher-end budgets, you may prefer to hire a full-service professional production team like Eventmobi’s GoLive! Production Team, or an outside A/V company.

There are a number of fixed costs for virtual events that need to be accounted for when calculating your cash flow. Fixed costs for virtual events tend to include:

You will also have some variable costs such as speaker fees and engagement items including swag boxes.

Unsurprisingly, hybrid event budgets are a mixture of line items typically found in an in-person-only and virtual-only budget. However, some additional technical costs need to be budgeted for to create a shared experience between your in-person and virtual audiences.

Hybrid event planners should budget for two A/V costs. One for your onsite A/V equipment, and the other for your remote A/V equipment. Onsite, it is preferable to have two camera placements with an operator for each, an IMAG operator, and a video switcher. For your remote A/V equipment, you will need:

Having two separate A/V teams with the necessary equipment allows you to create the best experience possible for your audiences. This is particularly important if you want to keep engagement high with your virtual attendees.

To cover expenses, consider different revenue avenues like:

Use budget planning tools such as Excel or Google Sheets to track these sources of revenue. Group your revenues in categories relevant to your event, such as “site,” “decorations,” or “publicity.” For hybrid events, consider broader categories like “in-person” and “virtual,” then subcategorize accordingly.

A critical aspect of budget planning is forecasting expenses and revenues. This can be done by reviewing past events or sourcing quotes for new costs. Remember to keep all invoices and receipts to back up your budget.

Also, you should always allocate a contingency fund for unexpected expenses. Finally, ensure your event is financially viable before moving to other aspects like venue selection, promotions, and staffing.

An event budget proposal is a document or presentation you’ll put together to convince stakeholders at your business to sign off on.

Fortunately, if you’ve already put together your projected budget for the event, you’re more than halfway through creating a solid budget proposal for your event. In addition to showing your expected revenue and expenses, you’ll want to include:

To calculate your cash flow, add up all your revenues and subtract the uncollected accounts receivables (money that is owed to you for services/work performed). This is your cash on hand before expenses. If you then subtract all of your accounts payable (money you owe for services/work provided to you) from that number, you will have your cash on hand. If the number is positive, you have a positive cash flow.

All Revenues – Uncollected Accounts Receivable = Cash on Hand Before Expenses

Cash on Hand Before Expenses – Accounts Payable = Cash on Hand

Starting cash is the amount of money you have readily available at the start of any given period.

As mentioned earlier, not all expenses can be forecasted and your budget will likely change during the event planning process. This makes it crucial to review and track your budget as you go.

If possible, arrange a meeting with your company’s accounting or financial officer to review the format of your event budget. This will help ensure that you’re in good shape before continuing the event planning process.

As demands for your meeting or event might change, it’s also a good idea to confirm in advance who would have the authority to spend beyond the approved budget. However, the earlier-mentioned contingency fund will come in handy when dealing with unplanned expenses.

Tracking your budget throughout your event, including the planning stages, is also important. Several helpful technology solutions on the market will support you in this quest like Expensify.

Transferring all of your financial systems to a cloud-based system will enable you to manage your financial operations anywhere, and anytime. Some examples of financial management software include CendynArcaneo, FreshBooks, and Certify.

First, go back to your success measures and benchmarks that you set before your event to determine if you were successful.

In the past decade, the emergence of new technologies has enabled planners to measure the overall performance of an event in multiple ways. Using qualitative and quantitative event data you are better able to quantify the performance of your event and show impact.

Return on Investment (ROI) is a performance measure used to evaluate how successful your event was. You might also want to compare different budgeting strategies based on their ROI. For example, do you get a higher ROI from the money you invest in outbound marketing, or from nurturing your existing attendee base?

Moreover, there are additional options for you to measure non-monetary business impacts that will help you calculate your event ROI, for example:

The EventMobi Event Management Platform offers advanced analytics to enable you to calculate your event ROI and easily share it with stakeholders and sponsors. With Eventmobi, you can track:

These data points can highlight the most valuable leads to sponsors whilst demonstrating the ROI of participating in your event.

Did you know that your existing tech stack probably already has event budget templates that you could use? For example, if you’re a Microsoft 365 user, you can type “event budget” into the search bar of the budget template designs page to find one that suits your needs. Sites like The Good Docs can also give you access to event budget templates for free.

Now that you know what an event budget consists of, what does it actually look like? You can build your budget however you’d like, but the easiest way may be to put it into a table like we’ve done in the event budget examples below.

In this example, you’re running an entirely in-person event for a single weekend, onsite at a hotel. You expect anywhere from 500 to 1000 people to attend, with the ultimate goal of bringing in revenue. You anticipate you’ll hire more booth rentals and sponsorships if you draw a larger crowd, but you’ll also require more staff on hand and more accommodations.

Here’s an example of what that event budget might look like: